For decedents dying July 13 2001 and after a release or certificate of non-liability from the West. You can also deduct.

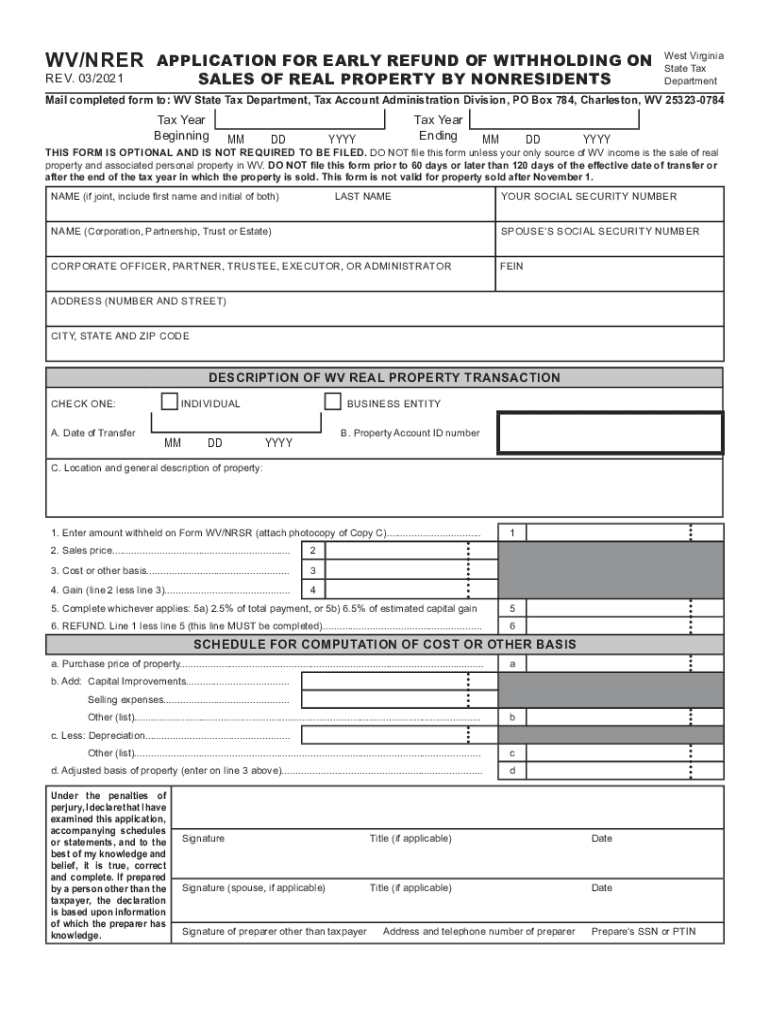

Form Nrer West Virginia State Tax Department Application For Early Refund Of Withholding On Sales Of Real Property By Nonresidents Updated Effective April 21 2008

The gift tax return is due on April 15th following the year in which the gift is made.

. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs. General Tax Information. Houses 6 days ago The average West Virginia property tax rate is 059 but this figure will vary widely from county to county.

31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a WV state return. Find IRS or Federal Tax Return deadline details. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Colliers WV.

However public service business property is assessed based upon operations as of December 31 each year. The tax period must end on the last day of a month. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs.

You as executor can file the estates first income tax return which may well be its last at any time up to 12 months after the death. All estates get a 600 exemption. 2020 State Tax Filing Deadline.

Refund Status Phone Support. Search for the document you need to electronically sign on your device and upload it. Payment of Additional Estate Taxes in WV.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. This final estate tax return is necessary only when an estate is large enough-at least 114 million in assets as of 2019-to require payment of estate taxes related to the. IT-141 Fiduciary Income Tax Return for Resident and Non-resident Estates and Trusts Instructions.

Any estate required to file a Federal Estate Tax Return Form 706 will be required to file a West Virginia Estate Tax Return. Besides the state estate tax you need to look out for the following. IT-140NRC West Virginia Nonresident Composite Return.

The West Virginia tax filing and tax payment deadline is April 18 2022. If you dont have an account yet register. West Virginia State Income Taxes for Tax Year 2021 January 1 - Dec.

Ad Valorem Property Tax. The Department of Revenue administers and enforces West Virginia revenue laws including the regulation of insurance banking and gaming industries as well as. Generally the estate tax return is due nine months after the date of death.

West Virginia State Tax Department will begin accepting individual 2021 tax returns on this date. In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate Tax Return Form 706. The proper forms and instructions will be sent to the ExecutorAdministrator after the appraisement has been filed.

Final individual federal and state income tax returns the federal and state tax returns are due by Tax Day of the year following the individuals death. If you are a non-resident estate or trust having source income use the forms below. Due date to file 2021 tax return request an extension and pay tax owed.

See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Dallas Pike WV. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Moundsville WV. The taxable year of the estate or trust for West Virginia income tax purposes is the same as the one used for federal tax purposes.

As of July 1 each year the ownership use and value of property are determined for the next calendar tax year. When you die there are many federal and estate tax situations that need to become a priority for those who survive you. Other Necessary Tax Filings.

Get wv state tax department fiduciary estate tax return forms 2009 signed right from your smartphone using these six tips. In Mercer County for example the property tax rate is 0523 or 1020 per year on a 250000 home while in Jefferson County the rate is 0676 or 1318 per year on a home of. Due date to file 2021 tax returns with approved extension.

The Ultimate Guide to West Virginia Real Estate Taxes. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Triadelphia WV. See reviews photos directions phone numbers and more for Estate Tax Return Preparation locations in.

For tax year 2021 the due date for an annual Estate or Trust West Virginia Fiduciary Income Tax return is April 18 2022. All real and tangible personal property with limited exceptions is subject to property tax. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related.

If you file in any month except December the estate has whats called a fiscal tax year instead of a calendar tax year.

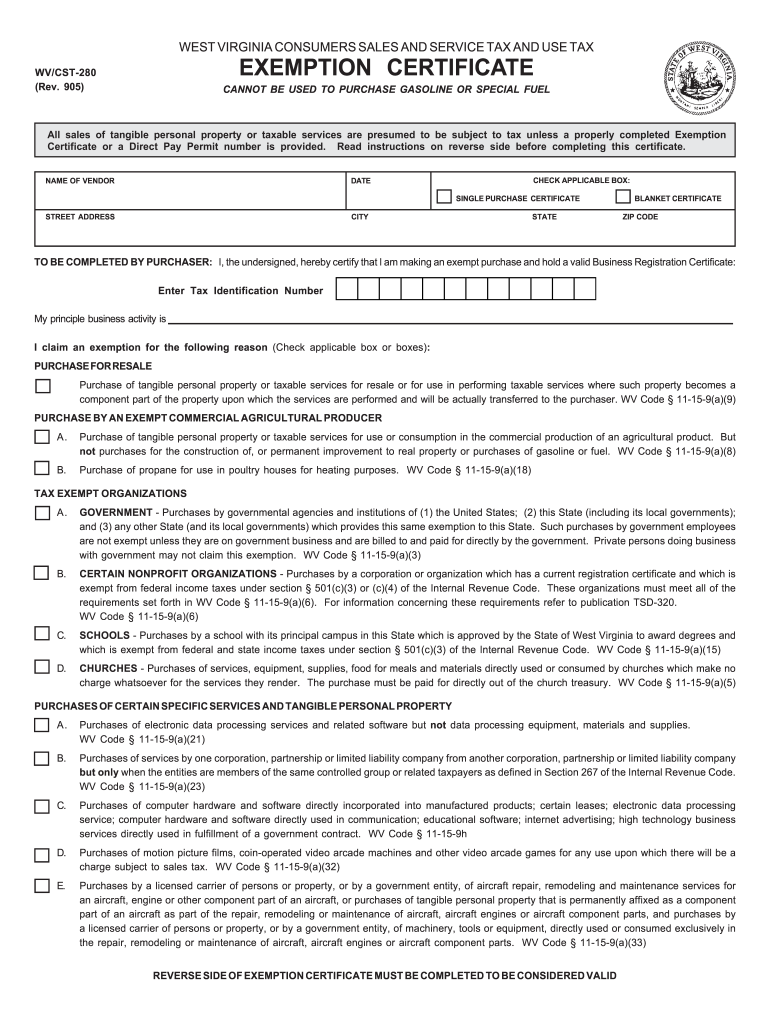

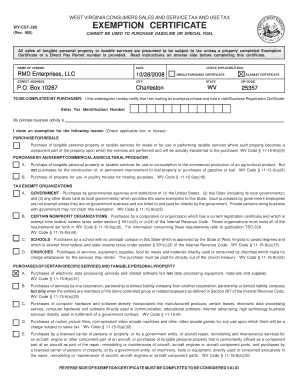

Wv Tax Exempt Form 2021 Fill Online Printable Fillable Blank Pdffiller

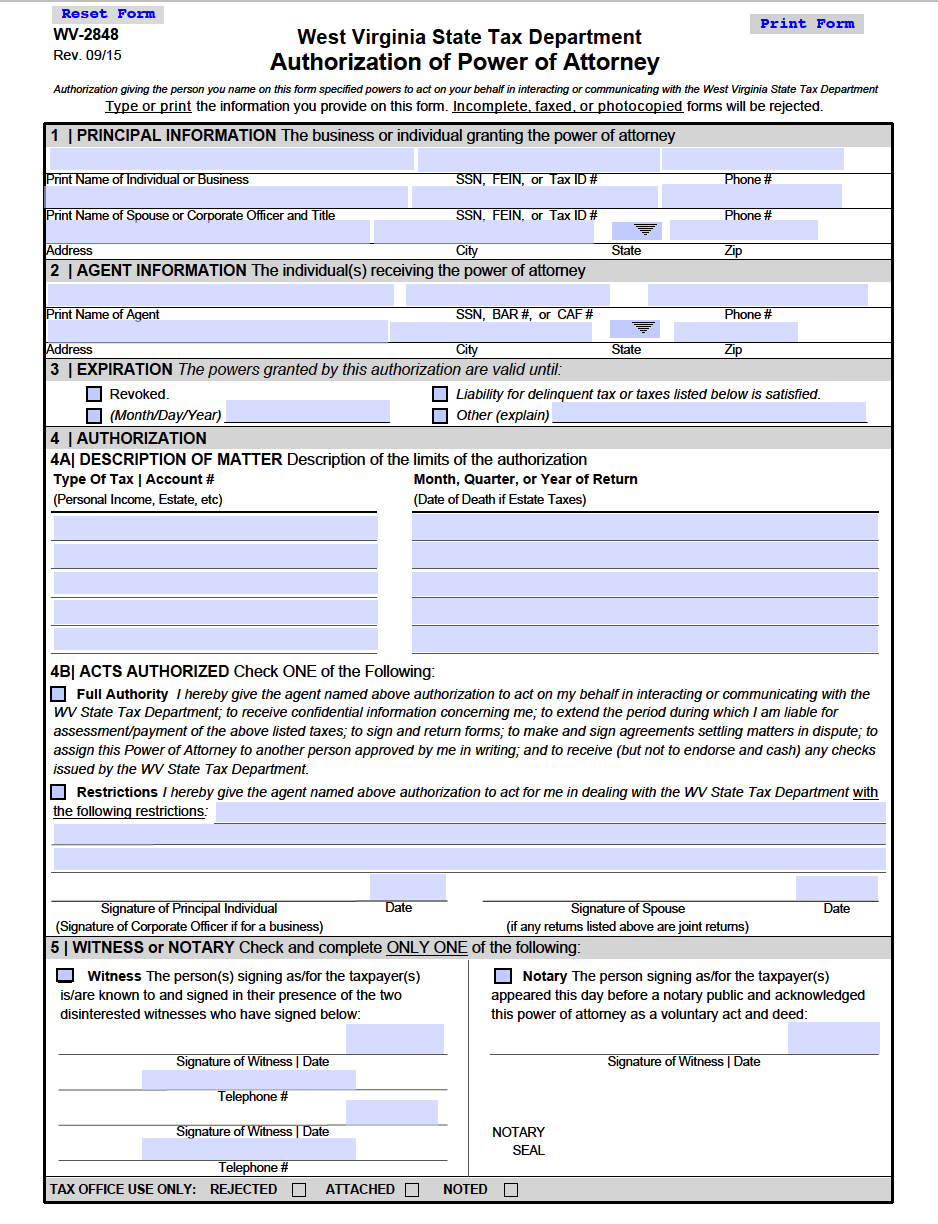

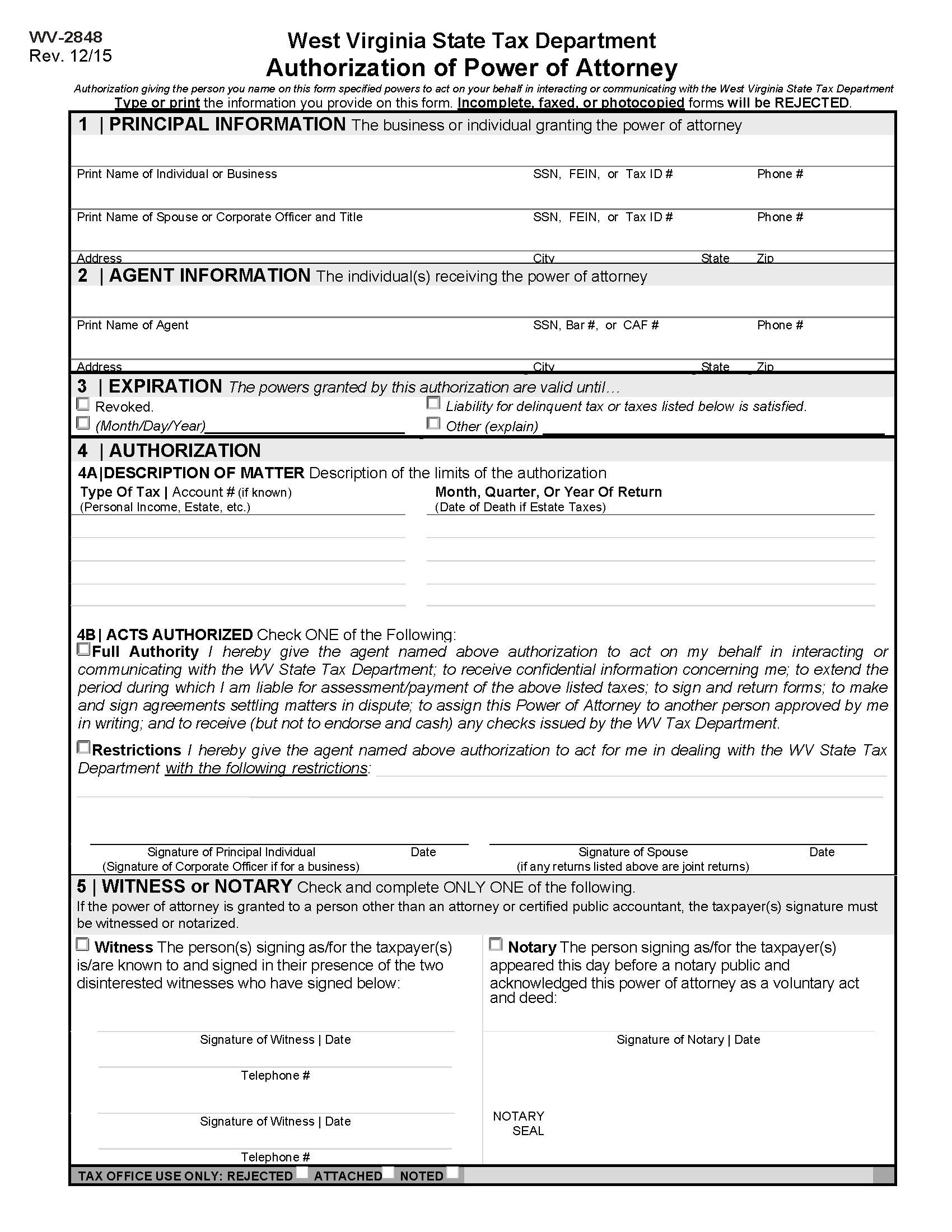

Free West Virginia Tax Power Of Attorney Form Wv 2848 Pdf Eforms

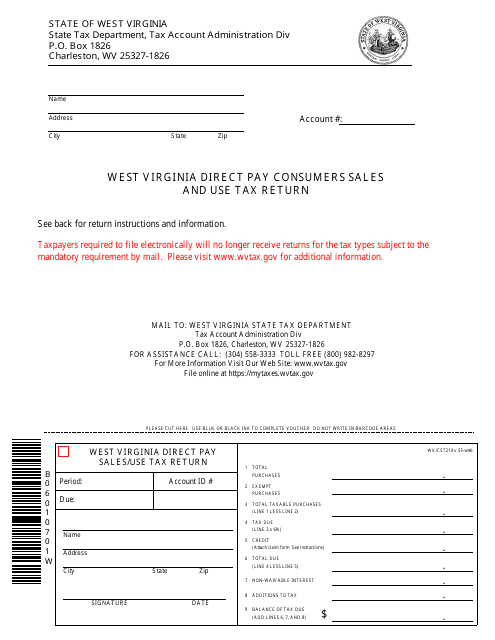

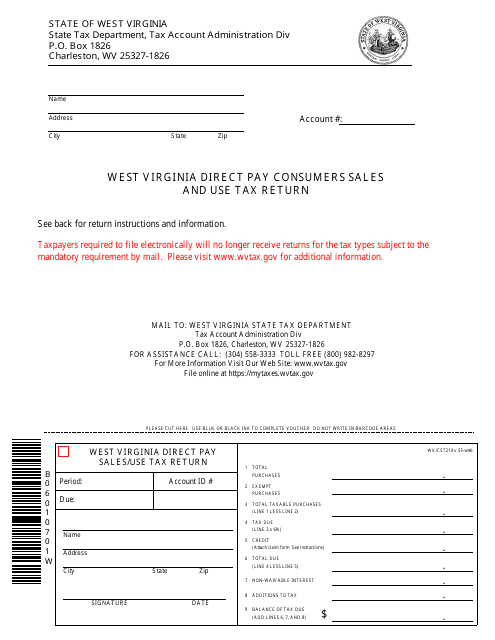

Form Wv Cst 210 Download Printable Pdf Or Fill Online West Virginia Direct Pay Consumers Sales And Use Tax Return West Virginia Templateroller

Free Tax Power Of Attorney West Virginia Form Adobe Pdf

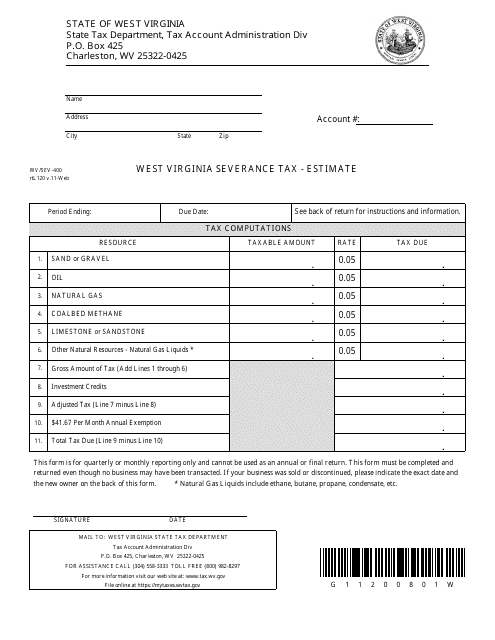

Form Wv Sev 400 Download Printable Pdf Or Fill Online Severance Tax Estimate West Virginia Templateroller

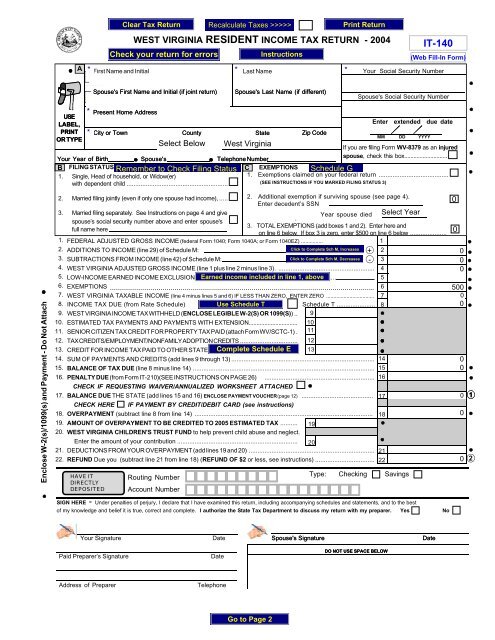

Form Wv It 140 State Of West Virginia

2012 2022 Form Wv Dor Nrsr Fill Online Printable Fillable Blank Pdffiller

Free West Virginia Tax Power Of Attorney Form Wv 2848 Pdf Word

Wv Cst 280 Fill Online Printable Fillable Blank Pdffiller

Wv W4 Fill Online Printable Fillable Blank Pdffiller

Estate Taxes In Wv Filing A Final Estate Tax Return And Other Responsibilities Blog Jenkins Fenstermaker Pllc

Free West Virginia Tax Power Of Attorney Form Pdf

Wv Tax Deadline Extended To May 17 Wowk 13 News

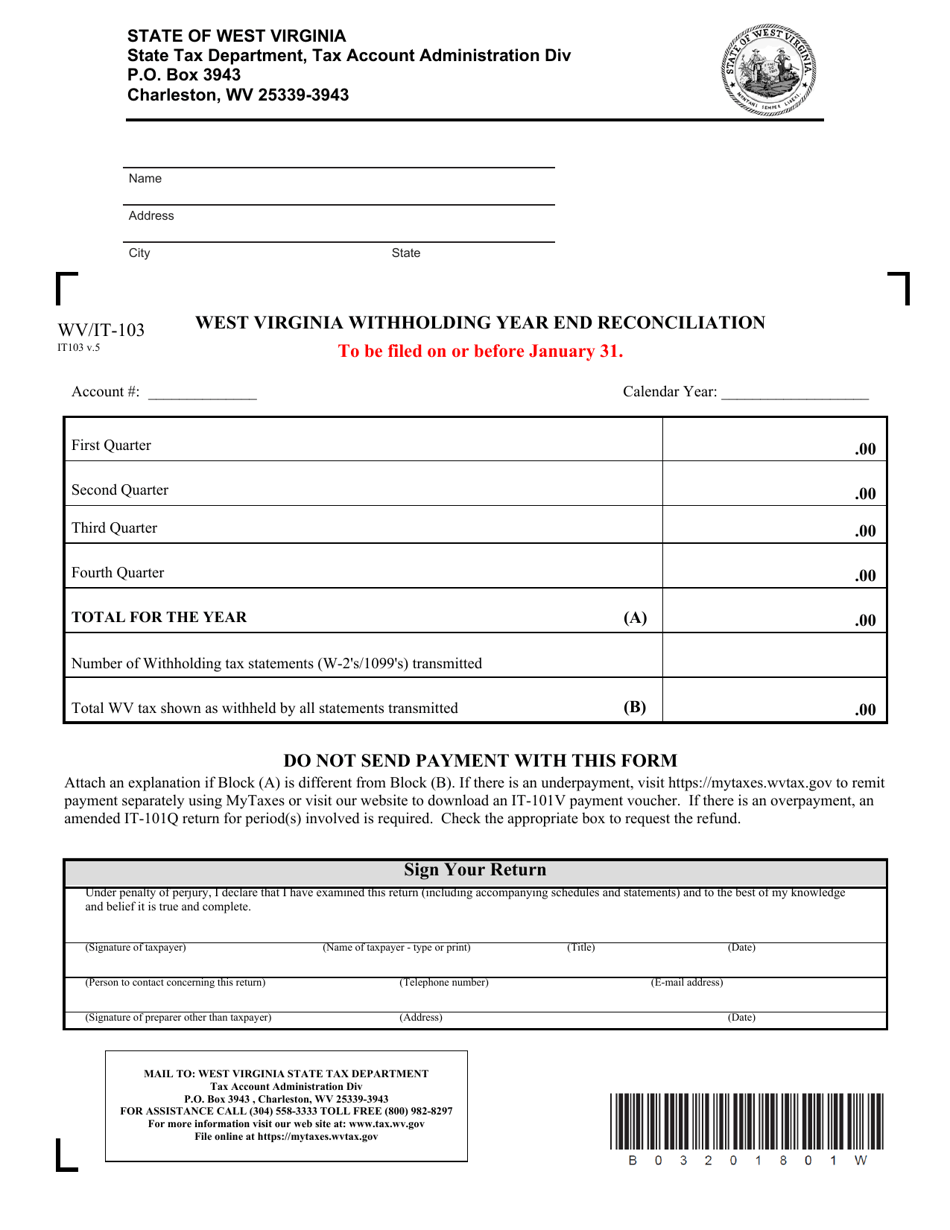

Form Wv It 103 Download Printable Pdf Or Fill Online West Virginia Withholding Year End Reconciliation West Virginia Templateroller

Wv State Tax Forms Fill Out And Sign Printable Pdf Template Signnow

Wv Schedule M It 140 2020 Fill Out Tax Template Online Us Legal Forms

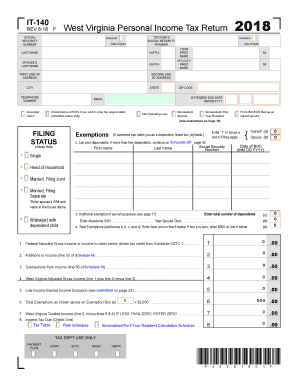

West Virginia Tax Forms 2019 Printable State Wv It 140 Form And Wv It 140 Instructions Tax Forms West Virginia Tax

2021 Form Wv Wv Nrer Fill Online Printable Fillable Blank Pdffiller

West Virginia Tax Forms And Instructions For 2021 Form It 140