For the election to be in effect for the current tax year the New Jersey S Corporation. Total first year cost of S-Corp.

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

For example if you have a.

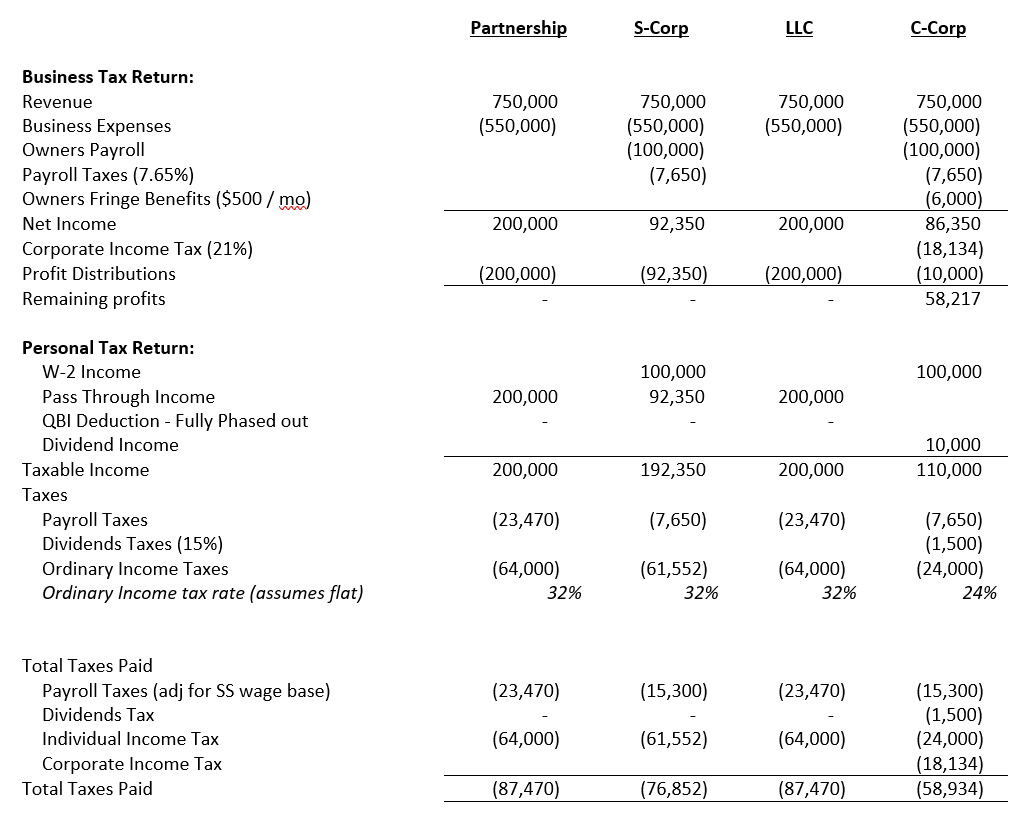

. The SE tax rate for business owners is 153 tax. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Annual state LLC S-Corp registration fees.

Estimated Local Business tax. An S corporation S Corp Subchapter S corporation under the IRS code is not taxed at the business level because it is a pass-through tax status for federal state and local. Check each option youd like to calculate for.

General Instructions for New Jersey S Corporation Business Tax Return and Related Forms - 2 - 187-116a1 through a7 must file the New Jersey Corporation Business Tax Return for. Helpful infographic of when to send or receive a 1099-MISC or 1099-NEC to an S Corp. As noted above a new jersey s corporation pays a.

New jersey income tax calculator 2021. A financial advisor in New Jersey can help you understand how taxes fit into your overall financial goals. New jersey state tax quick facts.

S-Corp or LLC making 2553 election. Nonprofit and Exempt Organizations. Licensed Professional Fees.

Financial advisors can also help with investing and financial planning -. Partnership Sole Proprietorship LLC. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

Pass-Through Business Alternative Income Tax PTE S Corporations Are Responsible for Payment Of New. C-Corp or LLC making 8832. Annual cost of administering a payroll.

File a New Jersey S Corporation Election using the online SCORP application. 63 amended the Corporation Business Tax Act by adding a tax at 1¾ based upon allocated net income to the tax based upon allocated net worth. Everything you need to know to pay contractors with Form 1099 Aug 18 2022 S Corp Tax.

What Is An S Corporation And Should You Form One Bench Accounting

Calculate Your S Corporation Tax Savings Zenbusiness Inc

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Paycheck Calculator Take Home Pay Calculator

Tax Savings Calculator For Llc Vs S Corp Gusto

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Memo Is Your S Corp Saving You Taxes Or Helping Evade Them Chris Whalen Cpa

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

What Is A Delaware S Corp Taxes Harvard Business Services

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

Try Our Free Corporation Tax Calculator Biztaxwiz

Corporate Tax In The United States Wikipedia

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

Premium Photo Tax Relief And Tax Forms With A Calculator To Calculate Taxes On A Gray Surface

Paycheck Calculator Take Home Pay Calculator

New Jersey Nj Tax Rate H R Block

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Llc Vs Corporation What Is The Difference Between An Llc And A Corporation Mycorporation